Why Funding Rate Math Matters for Crypto Traders

You see a funding rate of 0.01% on Hyperliquid. Is that good? What does it actually mean for your profits? How does it compare to traditional investment returns?

Understanding how to convert funding rates to annualized percentage rate (APR) is essential for:

- Comparing opportunities across different cryptocurrency exchanges

- Calculating expected profits from funding rate arbitrage

- Deciding if a trade is worth the transaction fees

- Understanding perpetual futures mechanics

- Benchmarking crypto yields against traditional finance

In this comprehensive guide, you will learn the exact formulas to convert any funding rate into APR - and how to calculate arbitrage spread returns for delta neutral strategies.

New to funding rates? Start with our complete funding rate guide first, or check our glossary of 60+ crypto funding terms.

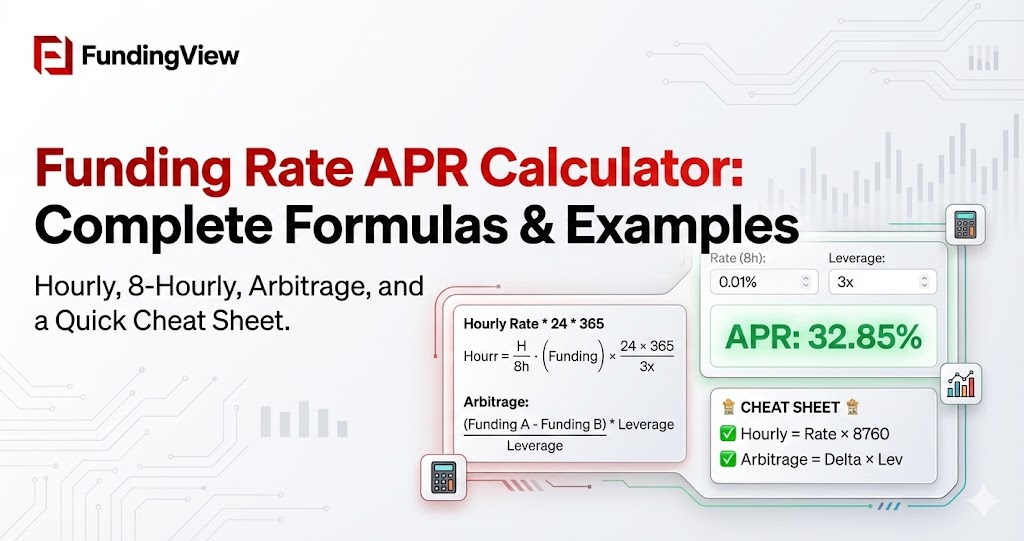

The Basic Funding Rate to APR Formula

Hourly Funding Rate to APR Conversion

Most decentralized perpetual exchanges like Hyperliquid, Paradex, and other perpetual DEXs charge funding every hour. To convert hourly rates to APR:

APR = Hourly Rate × 24 × 365 × 100

Example calculation:

- Hourly funding rate: 0.003% (or 0.00003 in decimal form)

- APR = 0.00003 × 24 × 365 × 100 = 26.28%

This means if you maintain a position receiving 0.003% hourly funding, you would earn approximately 26.28% annually on your position size.

8-Hourly Funding Rate to APR Conversion

Some exchanges like Binance, dYdX, and OKX charge funding every 8 hours (3 times per day). The formula adjusts accordingly:

APR = 8-Hour Rate × 3 × 365 × 100

Example calculation:

- 8-hour funding rate: 0.01% (or 0.0001 in decimal form)

- APR = 0.0001 × 3 × 365 × 100 = 10.95%

Quick Reference: Funding Rate to APR Conversion Table

Use this table for fast mental calculations when analyzing opportunities on the FundingView Dashboard:

| Funding Rate | Frequency | Annual APR |

|---|---|---|

| 0.001% | Hourly | 8.76% |

| 0.005% | Hourly | 43.80% |

| 0.01% | Hourly | 87.60% |

| 0.02% | Hourly | 175.20% |

| 0.05% | Hourly | 438.00% |

| 0.01% | 8-Hourly | 10.95% |

| 0.03% | 8-Hourly | 32.85% |

| 0.10% | 8-Hourly | 109.50% |

Bookmark this page for quick reference when trading!

Understanding Positive vs Negative Funding Rates

Funding rates can be positive or negative, which determines who pays whom:

| Rate Type | Longs Pay | Shorts Receive |

|---|---|---|

| Positive (+) | Yes | Yes |

| Negative (-) | No (receive instead) | No (pay instead) |

Positive funding rates indicate a bullish market - long position holders pay short position holders.

Negative funding rates indicate a bearish market - short position holders pay long position holders.

For a single position, your APR is simply the funding rate converted using the formulas above. If you are receiving funding, it is positive APR. If you are paying funding, it is negative APR and represents a cost.

This mechanism keeps perpetual futures prices aligned with spot market prices - a concept developed by major derivatives exchanges and explained in detail by the CME Group.

Calculating Arbitrage Spread APR

Funding rate arbitrage involves two positions on different exchanges. The spread between rates is what you actually earn as profit.

This strategy is central to crypto passive income and is used by professional trading firms worldwide.

The Basic Spread Formula

Spread APR = |Long Exchange APR - Short Exchange APR|

But the calculation is more nuanced in practice. Here is the complete methodology:

Step-by-Step Arbitrage APR Calculation

Scenario: You want to arbitrage ETH between Hyperliquid and Paradex.

| Exchange | Position | Hourly Rate | You... |

|---|---|---|---|

| Hyperliquid | Long | +0.005% | Pay 0.005% |

| Paradex | Short | +0.015% | Receive 0.015% |

Step 1: Calculate net hourly rate

Net Rate = Short Rate - Long Rate

Net Rate = 0.015% - 0.005% = 0.01%

Step 2: Convert to APR

APR = 0.01% × 24 × 365 = 87.6%

Your arbitrage position earns 87.6% APR (before accounting for trading fees).

This delta neutral strategy means you profit regardless of whether ETH price goes up or down - you are earning the spread between exchanges.

When Both Funding Rates Are Positive (Bull Market)

This is the most common scenario during cryptocurrency bull markets:

| Hyperliquid (Long) | Paradex (Short) | Net Hourly | Annual APR |

|---|---|---|---|

| +0.003% | +0.008% | +0.005% | 43.8% |

| +0.005% | +0.015% | +0.010% | 87.6% |

| +0.010% | +0.025% | +0.015% | 131.4% |

Rule: Go short on the exchange with the higher positive rate to maximize funding income.

Use the FundingView Strategy page to find these opportunities automatically.

When Both Funding Rates Are Negative (Bear Market)

In bear markets, funding rates flip negative:

| Hyperliquid (Short) | Paradex (Long) | Net Hourly | Annual APR |

|---|---|---|---|

| -0.008% | -0.003% | +0.005% | 43.8% |

| -0.015% | -0.005% | +0.010% | 87.6% |

Rule: Go long on the exchange with the higher negative rate (meaning less negative is better for your long position).

Bear markets still offer profitable arbitrage opportunities - rates simply flip direction.

Mixed Rates (Best Case Scenario)

Sometimes one exchange shows positive funding while another shows negative:

| Hyperliquid (Long) | Paradex (Short) | Net Hourly | Annual APR |

|---|---|---|---|

| -0.005% (you receive) | +0.010% (you receive) | +0.015% | 131.4% |

You get paid on both sides! This is the ideal arbitrage scenario and represents the highest-yielding opportunities.

Monitor the FundingView Dashboard to catch these rare but lucrative mixed-rate opportunities.

Accounting for Trading Fees in APR Calculations

Raw APR does not account for trading fees. Here is how to calculate net APR for realistic profit expectations:

Entry and Exit Fees Calculation

Total Fee Cost = (Entry Fee × 2) + (Exit Fee × 2)

You trade on two exchanges simultaneously, so multiply fees by 2.

Example:

- Hyperliquid: 0.035% taker fee

- Paradex: 0% fee (zero-fee exchange!)

- Total: (0.035% × 2) + (0% × 2) = 0.07%

This is why we recommend Paradex for arbitrage - zero fees significantly improve net returns.

Break-Even Time Calculation

How long until trading fees are recovered through funding income?

Break-Even Hours = Total Fee Cost ÷ Net Hourly Rate

Example:

- Total fees: 0.07%

- Net hourly rate: 0.01%

- Break-even: 0.07 ÷ 0.01 = 7 hours

After 7 hours, you transition from recovering costs to pure profit. This is why understanding the math is crucial before entering positions.

Net APR Formula for Longer Holds

For a position held X days, calculate net APR as follows:

Net APR = ((Net Hourly Rate × 24 × X) - Total Fees) ÷ X × 365 × 100

Example (30-day hold):

- Net hourly rate: 0.01%

- Total trading fees: 0.07%

- Gross profit: 0.01% × 24 × 30 = 7.2%

- Net profit: 7.2% - 0.07% = 7.13%

- Net APR: 7.13% ÷ 30 × 365 = 86.7%

The net APR closely approximates gross APR because fees are small relative to 30 days of accumulated funding income.

Real-World Calculation Example with Full Numbers

Let us walk through a complete example with realistic position sizes.

The Trading Setup

- Capital: $10,000 total ($5,000 per exchange)

- Position size: $5,000 (1x leverage on each side)

- Long position: Hyperliquid at +0.004% hourly funding

- Short position: Paradex at +0.012% hourly funding

- Fees: 0.035% (Hyperliquid) + 0% (Paradex) = 0.07% total round-trip

- Hold duration: 7 days

Step-by-Step Profit Calculation

Step 1: Calculate net hourly rate

Net Rate = 0.012% - 0.004% = 0.008%

Step 2: Calculate gross profit over 7 days

Gross Funding = 0.008% × 24 hours × 7 days = 1.344%

Dollar Profit = $10,000 × 1.344% = $134.40

Step 3: Subtract trading fees

Fees = $10,000 × 0.07% = $7.00

Net Profit = $134.40 - $7.00 = $127.40

Step 4: Annualize the returns

Net APR = ($127.40 ÷ $10,000) ÷ 7 × 365 × 100 = 66.4%

Result: $127.40 profit in 7 days = 66.4% annualized APR

This demonstrates why funding rate arbitrage is considered one of the highest-yielding crypto passive income strategies.

Using FundingView for Automated Calculations

Do not want to calculate manually every time? FundingView calculates everything automatically:

- Real-time funding rates across 12+ cryptocurrency exchanges

- Automatic APR conversion for all displayed rates

- Spread calculations between any two exchanges

- Historical data to identify consistent opportunities

- Strategy page with pre-ranked opportunities by APR

Open the FundingView Dashboard

The History Explorer lets you analyze historical funding patterns to find durable strategies that perform consistently over time.

Common Mistakes to Avoid When Calculating Funding APR

Mistake 1: Comparing Different Funding Frequencies

Hyperliquid charges hourly while Binance charges every 8 hours. You cannot compare rates directly - always convert to APR first using the formulas above.

Mistake 2: Ignoring Position Size Matching

Your long and short positions must be equal size for true delta-neutral arbitrage. A size mismatch exposes you to directional price risk, negating the arbitrage safety.

Mistake 3: Underestimating Fee Impact on Low Spreads

A 0.002% hourly spread (17.5% APR) sounds attractive, but with 0.1% total fees:

- Break-even time: 50 hours (over 2 days)

- Short-duration holds become unprofitable

Rule of thumb: Target spreads of at least 0.005% hourly (43.8% APR) to ensure fees do not erode profits.

Mistake 4: Using Snapshot Rates Without Checking History

Funding rates change every hour. A rate you see now might flip to the opposite direction in an hour. Use FundingView historical data to find consistent spreads rather than momentary spikes.

Mistake 5: Forgetting Leverage Impact on Liquidation

While higher leverage amplifies funding income, it also increases liquidation risk. Always calculate your liquidation prices before entering positions.

Funding Rate APR Cheat Sheet

Quick Conversions for Hourly Funding Rates

| Hourly Rate | Annual APR |

|---|---|

| 0.001% | 8.76% |

| 0.002% | 17.52% |

| 0.003% | 26.28% |

| 0.005% | 43.80% |

| 0.008% | 70.08% |

| 0.01% | 87.60% |

| 0.015% | 131.40% |

| 0.02% | 175.20% |

Quick Conversions for 8-Hourly Funding Rates

| 8-Hourly Rate | Annual APR |

|---|---|

| 0.01% | 10.95% |

| 0.02% | 21.90% |

| 0.03% | 32.85% |

| 0.05% | 54.75% |

| 0.10% | 109.50% |

The Master Formulas

APR = Rate × Periods Per Day × 365 × 100

For hourly rates: APR = Rate × 24 × 365 × 100

For 8-hourly rates: APR = Rate × 3 × 365 × 100

Bookmark this page for quick reference during trading sessions!

How Funding Rate APR Compares to Other Investments

Understanding how funding arbitrage returns compare to traditional investments provides important context:

| Investment Type | Typical Annual Return |

|---|---|

| Savings Account | 0.5-5% APY |

| Government Bonds | 4-6% yield |

| Corporate Bonds | 5-8% yield |

| S&P 500 Index | 7-10% average |

| Real Estate | 8-12% total return |

| Funding Rate Arbitrage | 30-80% APR |

The significant premium in crypto funding arbitrage exists because cryptocurrency markets are less efficient than traditional markets, creating persistent arbitrage opportunities.

Learn more about this comparison in our comprehensive crypto passive income guide.

Start Finding High-APR Funding Opportunities

Now that you understand the mathematics, put your knowledge into practice:

Step 1: Find Opportunities

- FundingView Dashboard - Real-time rates across all exchanges

- Strategy Page - Automatically ranked by APR

Step 2: Analyze Historical Performance

- History Explorer - Identify consistent patterns

Step 3: Learn Execution

- Earn Your First $100 - Complete beginner tutorial

- Spot and Perp Arbitrage - Advanced strategy

Step 4: Open Exchange Accounts

Get started with fee discounts using our referral links:

- Hyperliquid - Highest liquidity perpetual DEX

- Paradex - Zero trading fees = higher net APR

- Extended - Often has rate divergence from major exchanges

- Lighter - Unique orderbook model for altcoin arbitrage

- Vest - Community-focused perpetual trading

- Backpack - Solana ecosystem integration

Check all perpetual DEX offers and bonuses for maximum savings.

Frequently Asked Questions

What is a good funding rate APR for arbitrage?

Target a minimum of 40-50% annualized APR on spreads to ensure trading fees do not significantly impact returns. Higher spreads of 80%+ APR exist during volatile market conditions. Use FundingView to monitor current opportunities.

How often should I check funding rates?

Funding rates change hourly on most exchanges. For active arbitrage, check rates every few hours. For passive monitoring, the FundingView Strategy page ranks opportunities for you.

Can funding rates go negative and stay negative?

Yes, during extended bear markets, funding rates can remain negative for days or weeks. This simply means you reverse your positions - go long where rates are most negative and short where rates are least negative or positive.

How accurate are APR projections?

APR projections assume rates remain constant, which they do not. Treat APR as a point-in-time estimate. Use historical data to understand typical rate ranges for more realistic expectations.

Related Articles

Deepen your understanding of funding rate trading:

Fundamentals

- What Are Funding Rates? Complete Guide - Start here if new to funding

- Crypto Funding Rate Glossary - 60+ terms defined

- What is FundingView? - Platform overview

Strategy Guides

- Earn Your First $100 with Funding Arbitrage - Beginner tutorial

- Spot and Perp Arbitrage Strategy - Advanced technique

- Best Crypto Passive Income Strategies 2025 - Strategy comparison

- Durable Strategies for XP and Airdrops - Long-term opportunities

Risk Management

- Is Funding Arbitrage Safe? - Complete risk analysis

Platform Reviews

- Paradex Review 2025 - Zero-fee trading analysis

- FundingView Vision - Why we built this free tool

Tools

- FundingView Dashboard - Real-time funding rates

- Strategy Page - Ranked opportunities

- History Explorer - Historical analysis

- Perpetual DEX Offers - Exchange bonuses