The Quest for Crypto Passive Income in 2025

Everyone wants their cryptocurrency to work for them. But with dozens of yield strategies available in 2025, how do you know which one actually delivers consistent, sustainable returns without putting your capital at extreme risk?

Whether you are searching for crypto passive income, DeFi yield farming, perpetual funding rates, or delta neutral strategies, this comprehensive guide compares the top 5 crypto passive income strategies for 2025:

- Funding Rate Arbitrage (using tools like FundingView)

- Staking (Proof-of-Stake and Liquid Staking)

- Lending (CeFi and DeFi protocols)

- Liquidity Providing (LP on DEXs)

- Yield Farming (DeFi incentives)

We will analyze each strategy's realistic APR, risk level, capital requirements, and effort needed so you can make an informed decision about where to invest your digital assets.

New to funding rates? Start with our complete guide to funding rates before diving into this comparison.

What is Crypto Passive Income?

Crypto passive income refers to earnings generated from your cryptocurrency holdings without actively trading. Unlike day trading or swing trading, passive income strategies allow your digital assets to generate returns while you hold them.

According to Investopedia, passive income is earnings derived from investments in which a person is not actively involved. In the cryptocurrency world, this concept has evolved significantly since Bitcoin launched in 2009.

The most common forms of crypto passive income include:

- Staking rewards from Proof-of-Stake blockchains

- Interest payments from lending platforms

- Trading fees from liquidity providing

- Funding payments from perpetual futures arbitrage

Each method carries different risk-reward profiles, which we will explore in detail below.

1. Funding Rate Arbitrage - The Highest Risk-Adjusted Returns

What it is: Opening opposite positions (long and short) on two different perpetual futures exchanges to capture the funding rate spread while remaining delta neutral and market neutral.

This strategy is the core focus of FundingView - our free platform that tracks funding rates across 12+ cryptocurrency exchanges in real-time.

How Funding Rate Arbitrage Works

Perpetual futures exchanges like Hyperliquid, Binance, and decentralized perpetual DEXs charge a funding rate every 1-8 hours to keep derivative prices aligned with spot markets. This mechanism is explained in detail by CME Group.

When funding rates differ between exchanges, you can:

- Go long on the exchange with lower (or negative) funding rates

- Go short on the exchange with higher (or more positive) funding rates

- Collect the spread as pure profit every funding period

Your positions cancel out price movement - you are market neutral. You do not care if Bitcoin goes to $200,000 or crashes to $20,000. This is why funding arbitrage is often called a delta neutral strategy or cash and carry trade.

Want to understand the math? Check our detailed guide on how to calculate funding rate APR with step-by-step formulas.

Realistic Funding Arbitrage Returns in 2025

Based on historical data from FundingView and market analysis:

| Market Condition | Typical APR | Notes |

|---|---|---|

| Bull market | 50-150% APR | High funding creates high spreads |

| Neutral market | 20-50% APR | Moderate but consistent opportunities |

| Bear market | 10-30% APR | Lower but still positive returns |

Average realistic expectation: 30-80% APR

Use the FundingView Dashboard to find current funding rate opportunities in real-time. Our Strategy page ranks the best opportunities by expected APR.

Funding Arbitrage Pros and Cons

Pros:

- Highest risk-adjusted returns of any crypto yield strategy

- Market-neutral - no directional exposure to price movements

- Works in bull, bear, or sideways markets

- Fully decentralized perpetual DEX options available for self-custody

- Earn exchange points and airdrops on top of funding income (see our airdrop guide)

- Zero trading fees on exchanges like Paradex

- Transparent and verifiable on-chain

Cons:

- Requires monitoring (though less than active day trading)

- Liquidation risk if leverage is too high without proper risk management

- Capital split across multiple exchanges

- Learning curve for beginners (see our beginner tutorial)

Risk Level: Low to Medium (when properly managed with our risk management guide)

Best for: Traders with $1,000+ who want high yields without making directional market bets.

Ready to start? Follow our step-by-step tutorial: Earn Your First $100 with Funding Arbitrage

Best Exchanges for Funding Arbitrage in 2025

To execute funding rate arbitrage, you need accounts on multiple perpetual DEXs. Here are our top recommendations:

- Hyperliquid - Highest liquidity perpetual DEX, best for large positions, HYPE token with strong tokenomics

- Paradex - Zero trading fees, excellent XP program, backed by Paradigm (read our full Paradex review)

- Extended - Growing liquidity, strong airdrop potential for early users

- Lighter - Orderbook-based perpetual DEX with unique arbitrage opportunities

- Vest - Community-focused perpetual exchange

- Backpack - Solana ecosystem perpetuals

See all perpetual DEX offers and discounts to maximize your trading savings.

2. Crypto Staking - Simple but Lower Returns

What it is: Locking your tokens to help secure a Proof-of-Stake blockchain in exchange for staking rewards and network validation incentives.

Staking is one of the most accessible forms of crypto passive income and is supported by major assets like Ethereum, Solana, and Cosmos.

How Crypto Staking Works

You delegate your tokens (ETH, SOL, ATOM, TIA, and others) to a validator node. The network pays you a portion of block rewards and transaction fees for helping secure the blockchain through Proof-of-Stake consensus.

Liquid staking protocols like Lido, Rocket Pool, and Jito give you a receipt token (stETH, rETH, JitoSOL) that you can use elsewhere in DeFi while your tokens remain staked. This unlocks capital efficiency.

Realistic Staking Returns in 2025

| Asset | Native Staking APR | Liquid Staking APR |

|---|---|---|

| ETH | 3-4% | 3-4% |

| SOL | 6-8% | 7-9% |

| ATOM | 15-20% | 15-18% |

| TIA | 10-15% | 12-16% |

Average realistic expectation: 4-15% APR depending on the asset and validator

Staking Pros and Cons

Pros:

- Very passive - set it and forget it

- Low risk for established chains like Ethereum

- Liquid staking maintains liquidity and DeFi composability

- Simple to understand for beginners

- No active management required

- Contributes to network security

Cons:

- Low yields compared to funding rate arbitrage

- Locked capital with unbonding periods (21 days for Cosmos chains)

- Exposed to token price volatility (not market neutral)

- Slashing risk exists (rare but possible)

- Inflationary tokenomics dilute real returns

Risk Level: Low

Best for: Long-term HODLers who want modest yield on assets they would hold anyway.

Comparison: While staking ETH gives you 3-4% APR, funding rate arbitrage can yield 30-80% APR with similar or lower risk when executed correctly with proper position sizing.

3. Crypto Lending - Earn Interest on Your Holdings

What it is: Lending your cryptocurrency to borrowers in exchange for interest payments, similar to traditional fixed income.

How Crypto Lending Works

CeFi Lending: Deposit on centralized platforms (exercise caution after Celsius and BlockFi collapses). They lend to institutions and share profits with depositors.

DeFi Lending: Supply assets to protocols like Aave, Compound, or Solana-based Kamino. Smart contracts automatically match lenders with borrowers in a trustless manner.

Realistic Lending Returns in 2025

| Platform Type | Stablecoins APR | BTC and ETH APR | Altcoins APR |

|---|---|---|---|

| CeFi platforms | 8-12% | 3-5% | 5-10% |

| DeFi Aave and Compound | 2-8% | 0.5-3% | 1-5% |

| DeFi Kamino and Marginfi | 5-15% | 2-6% | 5-20% |

Average realistic expectation: 5-12% APR on stablecoins

Lending Pros and Cons

Pros:

- Very passive income stream

- Stablecoin lending means no price exposure (like USDC or DAI)

- Multiple platform options across chains

- Usually can withdraw anytime (no lock-up)

- DeFi options are permissionless and transparent

Cons:

- CeFi means counterparty risk (remember Celsius, BlockFi, and Voyager collapses)

- DeFi means smart contract risk and potential exploits

- Rates fluctuate with market demand

- Lower yields than funding rate strategies

- Utilization rate affects actual returns

Risk Level: Low for established DeFi protocols, Medium to High for CeFi

Best for: Conservative investors wanting stable, predictable income on stablecoins without volatility exposure.

Better alternative: Funding rate arbitrage with stablecoins as collateral offers 3-8x higher returns with managed risk.

4. Liquidity Providing - Earn Trading Fees

What it is: Depositing token pairs into decentralized exchange (DEX) pools to earn a share of trading fees generated by swaps.

Liquidity providing powers DEXs like Uniswap, SushiSwap, Orca, and Raydium.

How Liquidity Providing Works

You provide equal value of two tokens (for example ETH plus USDC) to a liquidity pool using an Automated Market Maker (AMM). Traders swap through your liquidity, and you earn a percentage of all trading fees.

Concentrated liquidity on Uniswap V3 or Orca Whirlpools lets you focus capital in specific price ranges for higher capital efficiency and yields.

Realistic LP Returns in 2025

| Pool Type | Typical APR | Impermanent Loss Risk |

|---|---|---|

| Stablecoin pairs (USDC-USDT) | 2-10% | Very Low |

| Blue chip pairs (ETH-USDC) | 5-20% | Medium |

| Volatile pairs (MEME-SOL) | 50-500% | Very High |

Average realistic expectation: 10-30% APR after accounting for impermanent loss

LP Pros and Cons

Pros:

- Can achieve high yields on volatile pairs

- Earn real trading fees from actual volume

- Multiple chains and DEX options

- Concentrated liquidity boosts capital efficiency

- Permissionless and decentralized

Cons:

- Impermanent Loss - the silent killer of LP returns that can wipe out gains

- Requires active rebalancing for concentrated positions

- Complex to optimize properly for maximum returns

- Exposed to both tokens price movements simultaneously

- Gas fees eat into profits on Ethereum mainnet

Risk Level: Medium to High

Best for: DeFi-savvy users who understand impermanent loss mathematics and can actively manage positions.

Better alternative: Funding rate arbitrage offers similar or higher APR without impermanent loss risk since positions are balanced.

5. Yield Farming - High Risk, Variable Rewards

What it is: Chasing the highest yields across DeFi protocols, often involving multiple steps and token incentives that may depreciate.

How Yield Farming Works

Protocols offer governance or reward tokens to attract liquidity and bootstrap growth. The typical yield farming process:

- Deposit assets into a protocol

- Receive LP tokens as a receipt

- Stake LP tokens for bonus reward tokens

- Compound rewards back into the strategy (or sell)

Often involves leveraged strategies or points programs promising future airdrops from venture-backed protocols.

Realistic Yield Farming Returns in 2025

| Strategy Type | Advertised APR | Realistic APR After Token Depreciation |

|---|---|---|

| Simple farms | 20-50% | 10-30% |

| Leveraged farms | 100-500% | 20-80% |

| Points and Airdrop farming | Unknown | Highly variable |

Average realistic expectation: 15-40% APR if you time token sales correctly

Yield Farming Pros and Cons

Pros:

- Highest potential advertised yields

- Airdrop opportunities from new protocols

- First-mover advantages on emerging platforms

- Can stack multiple reward types

Cons:

- Reward tokens often dump 80%+ after launch

- High complexity and gas costs

- Rug pull risk on unaudited protocols

- Constant monitoring and rotation required

- Advertised APRs rarely sustainable long-term

- Smart contract and exploit risk

Risk Level: High to Very High

Best for: Experienced DeFi power users who understand the risks and can rotate positions quickly.

More sustainable alternative: Funding rate arbitrage provides high yields without relying on depreciating reward tokens.

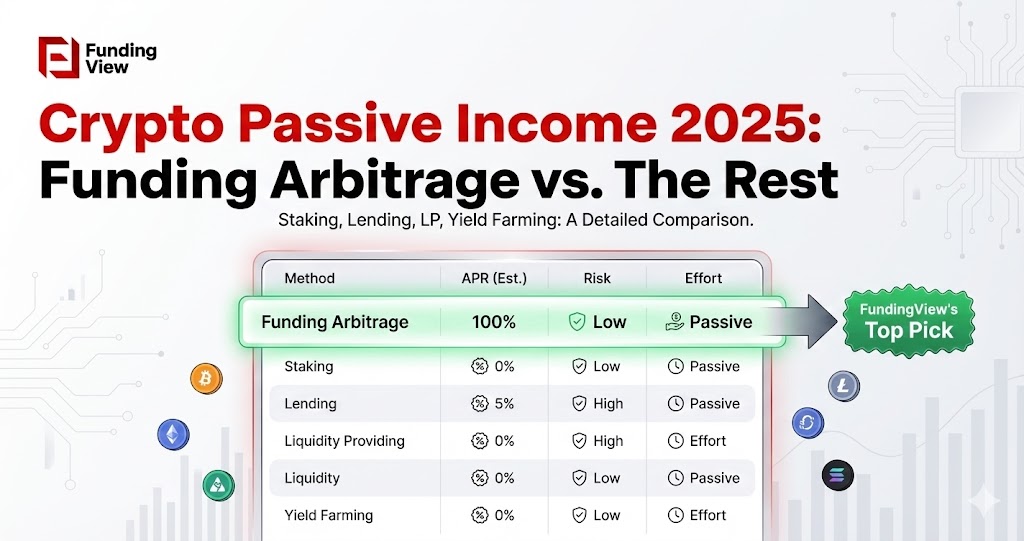

Crypto Passive Income Comparison Table 2025

| Strategy | Realistic APR | Risk Level | Effort Required | Minimum Capital | Market Neutral |

|---|---|---|---|---|---|

| Funding Arbitrage | 30-80% | Low-Medium | Medium | $500 | Yes |

| Staking | 4-15% | Low | Very Low | $100 | No |

| Lending Stablecoins | 5-12% | Low-Medium | Very Low | $100 | Yes |

| Liquidity Providing | 10-30% | Medium-High | Medium | $500 | No |

| Yield Farming | 15-40% | High | High | $1,000 | No |

The Verdict: Why Funding Rate Arbitrage Wins in 2025

For risk-adjusted returns, funding rate arbitrage is the clear winner for sophisticated passive income seekers.

Here is why:

- Highest Sharpe ratio - Best returns relative to risk taken according to modern portfolio theory

- Market neutral - Profitable in bull, bear, or crab markets

- No impermanent loss - Unlike LP positions on AMMs

- No token dump risk - Unlike yield farming reward tokens

- Decentralized options - Unlike risky CeFi lending platforms

- Bonus airdrops - Earn exchange points while arbitraging (see durable strategies guide)

- Transparent execution - All trades verifiable on-chain

The main trade-off is effort. Staking is more passive, but the 3-15% APR reflects that simplicity. With FundingView, finding and monitoring funding arbitrage opportunities becomes significantly easier.

How to Get Started with Funding Rate Arbitrage

Ready to try the highest-yielding crypto passive income strategy of 2025?

Step 1: Learn the Fundamentals

Build a strong foundation with these educational resources:

- What Are Funding Rates? - Understand the core mechanics

- How to Calculate Funding Rate APR - Master the mathematics

- Is Funding Arbitrage Safe? - Know the risks before you start

- Crypto Funding Rate Glossary - 60+ terms explained

Step 2: Find Opportunities

Use FundingView tools to identify profitable trades:

- FundingView Dashboard - Real-time rates across 12+ exchanges

- Strategy Page - Pre-calculated best opportunities

- History Explorer - Analyze historical funding data and patterns

Step 3: Execute Your First Trade

Follow our beginner-friendly tutorials:

- Earn Your First $100 - Complete beginner tutorial with Paradex

- Spot and Perp Arbitrage Strategy - Advanced technique for higher capital efficiency

Step 4: Open Exchange Accounts

Get fee discounts and bonuses with our referral links:

- Hyperliquid - Top perpetual DEX by trading volume, HYPE token holder

- Paradex - Zero trading fees, best for arbitrage profitability

- Extended - Growing exchange with strong airdrop potential

- Lighter - Unique orderbook DEX for altcoin arbitrage

- Vest - Community-focused perpetual trading

- Backpack - Solana ecosystem integration

Browse all perpetual DEX offers and bonuses for maximum savings.

Frequently Asked Questions About Crypto Passive Income

Which crypto passive income strategy is best for beginners?

Staking is the easiest to start - just delegate your tokens and wait for rewards. But if you want higher returns without directional risk, funding rate arbitrage is worth learning. Our beginner guide walks you through everything step by step with screenshots.

How much can I realistically earn with crypto passive income in 2025?

Expected returns vary significantly by strategy:

- Staking: 4-15% APR depending on the asset

- Lending: 5-12% APR on stablecoins

- Funding Arbitrage: 30-80% APR with proper execution

- Liquidity Providing: 10-30% APR after impermanent loss

Learn exactly how to calculate funding rate APR with our detailed formula guide.

Can I combine multiple passive income strategies?

Yes, and many successful crypto investors diversify across strategies. A common portfolio approach:

- Stake long-term holdings like ETH and SOL for baseline yield

- Use stablecoins for funding rate arbitrage for maximum returns

- Allocate a small percentage to yield farming for airdrop exposure

- Keep emergency funds in lending protocols for liquidity

Diversification across strategies reduces overall portfolio risk while maximizing returns.

What is the minimum capital needed for each passive income strategy?

| Strategy | Minimum Capital | Recommended Capital |

|---|---|---|

| Staking | $100 | $1,000+ |

| Lending | $100 | $1,000+ |

| Funding Arbitrage | $500 | $2,000+ |

| Liquidity Providing | $500 | $2,000+ |

| Yield Farming | $1,000 | $5,000+ |

Lower amounts work but trading fees, gas costs, and slippage eat into profits significantly. Higher capital means better capital efficiency.

Are these crypto yields sustainable long-term?

Staking and lending rates are relatively stable and tied to network activity and borrowing demand.

Funding arbitrage depends on market activity and speculation - rates are higher in volatile markets but opportunities exist in all conditions. Use FundingView to track current conditions and historical averages.

Yield farming rewards almost always decrease over time as more capital enters and reward tokens are diluted or sold.

What is the safest crypto passive income strategy?

Staking established chains like Ethereum has the lowest risk but also the lowest returns at 3-4% APR.

For higher yields with managed risk, funding rate arbitrage on established perpetual DEXs offers excellent risk-adjusted returns. Read our complete risk management guide to understand how to protect your capital.

Is funding rate arbitrage legal?

Yes, funding rate arbitrage is completely legal. It is a legitimate market-neutral trading strategy used by professional trading firms, hedge funds, and individual traders worldwide. You are simply taking advantage of price discrepancies between markets - a practice that actually helps improve market efficiency.

How does funding rate arbitrage compare to traditional finance yields?

Traditional finance offers approximately:

- Savings accounts: 0.5-5% APY

- Bonds: 4-7% yield

- Dividend stocks: 2-4% yield

Crypto funding rate arbitrage at 30-80% APR significantly outperforms traditional finance while maintaining market neutrality similar to bond strategies. This premium exists because crypto markets are less efficient and more volatile than traditional markets.

Conclusion: Best Crypto Passive Income Strategy for 2025

There is no single best passive income strategy - it depends on your:

- Risk tolerance - How much volatility and complexity can you handle

- Time commitment - How actively can you manage positions

- Capital size - Larger capital opens more opportunities and efficiency

- Market outlook - Bullish, bearish, or neutral expectations

But for those seeking the highest risk-adjusted returns without betting on market direction, funding rate arbitrage stands out as the clear winner in 2025.

With tools like FundingView making it easy to find opportunities across 12+ exchanges, and zero-fee exchanges like Paradex reducing costs, there has never been a better time to start earning crypto passive income through funding rates.

Start finding opportunities on FundingView - completely free

Related Articles

Expand your crypto passive income knowledge with these guides:

Beginner Resources

- What Are Funding Rates? Complete Guide

- How to Calculate Funding Rate APR

- Crypto Funding Rate Glossary - 60+ Terms

Strategy Guides

- Earn Your First $100 with Funding Arbitrage

- Spot and Perp Arbitrage Strategy

- Durable Strategies for XP and Airdrops

Risk Management

Platform Reviews

- Paradex Review 2025 - Zero Fee Trading

- What is FundingView?

- FundingView Vision - Why We Built a Free Platform

Tools

- FundingView Dashboard - Real-time funding rates

- Strategy Page - Best opportunities ranked

- History Explorer - Historical data analysis

- Perpetual DEX Offers - Exchange discounts and bonuses